Retirement is generally meant to be a relaxing time, a time to kick back and unwind after a life time of work. Many use retirement as an opportunity to jet set, do up their house or spend more time with the family. But now, retirees are facing havoc in the property market.

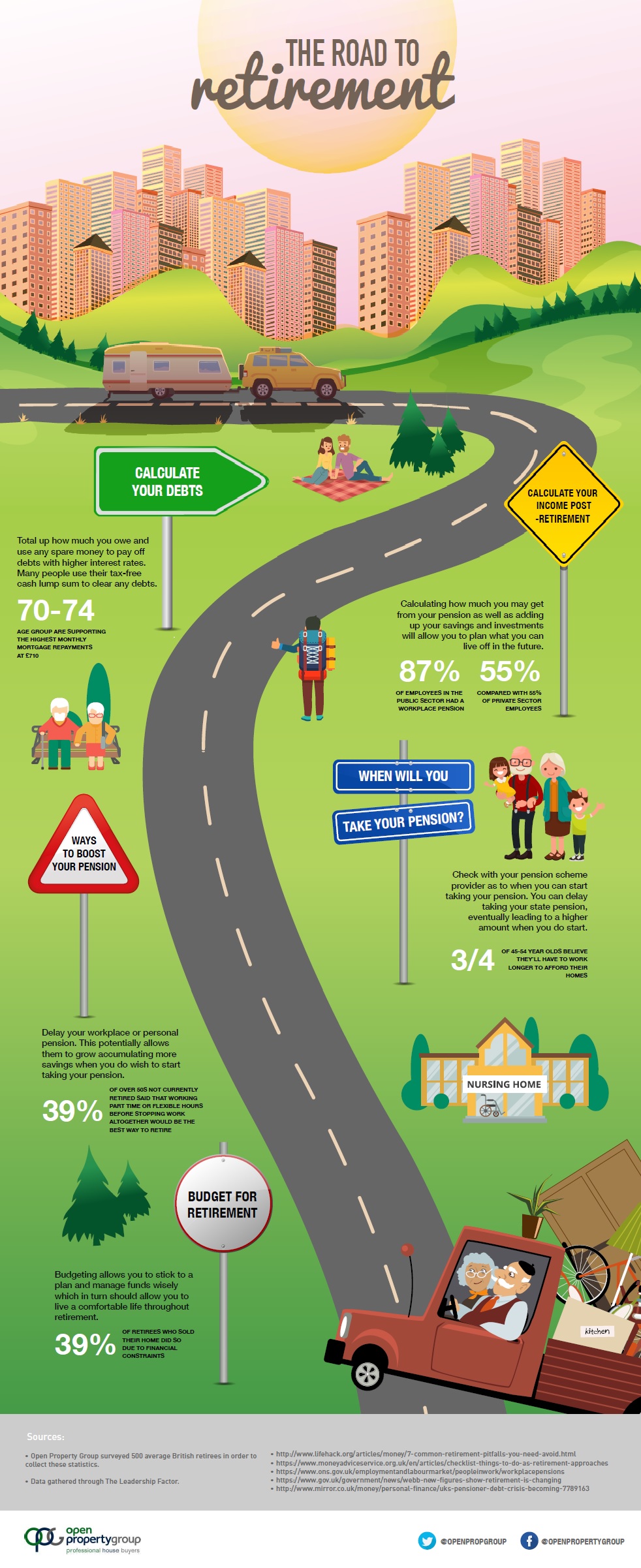

Indeed, many retired homeowners in the UK are having to jump off the property ladder to pay off their own or their children’s debts. According to brand new research by fast house buyers Open Property Group, 39% of retirees who sold their house, did so due to extreme financial pressures.

Open Property Group’s research highlights an improving, yet perennial problem. Back in 2013, Property Wire reported that 40% of retired home owners were forced to sell their homes to pay off existing debts. The situation is less than ideal but there are many ways those planning to retire, as well as current retirees, can take to prevent this from happening.

Below we run through the steps you need to take to make sure you don’t end up another statistic:

Move to a cheaper area or downsize

One way to save money is move to less expensive area. Although your current property may seem like your ideal, comfortable and angelic home, it might lead you to spend more on utility bills, taxes and groceries than you realise, particularly if you live in a large home.

Traditionally, the bigger the home, the more expensive the upkeep is. Downsizing and moving to a less expensive area will save you a small fortune in the long, and allows you the opportunity to a new place.

If you do decide to move, be sure to consider the accessibility of a property as this will be hugely beneficial as you get older and save you even more money in the long run.

Stick to tight budgets

In terms of saving, it’s a good idea to work out a retirement budget upon retiring; this will help you to plan for the future and will prevent any nasty financial surprises. Include a list in the budget of the areas that has money outgoing, (e.g. Things like utilities, cable TV, phone bills and holidays).

With this list, be sure to leave room in the budget for any unforeseen circumstances that may see a dent in your bank balance, this will include things such as medical bills, emergency trips to see family members and repairs around the home.

You can also save money by cutting many of your outgoing bills. If you no longer have your kids around, is there really need any need to have all of the channels on cable TV? You can downgrade your mobile phone plan too. And since you’re no longer commuting, if you and your partner have a car each, you may wish to consider to cutting it down to just one. It will save you heaps on fuel, tax and repairs.

Don’t feel that you have to avoid working

Another way to save money when retiring is to carry on working. Of course this won’t involve anything too strenuous as retirement is your time, but a part-time job can really help your finances as well as helping you to stay mentally active. There also many work from home jobs which allow you to make a steady income without leaving the house.

Perhaps using your lifetime’s work of experience, you could become a freelance content writer and/or journalist. Many sites now welcome guest contributions and some (such as national papers) pay good money for well written and engaging opinion pieces.

Make the most of your benefits

Finally, take advantage of senior citizen discounts. Many places, whether it’s theme parks, museums, sporting events, restaurants or public transport offer a discount, so be sure to get that travel pass and purchase the senior citizen option when visiting anywhere.