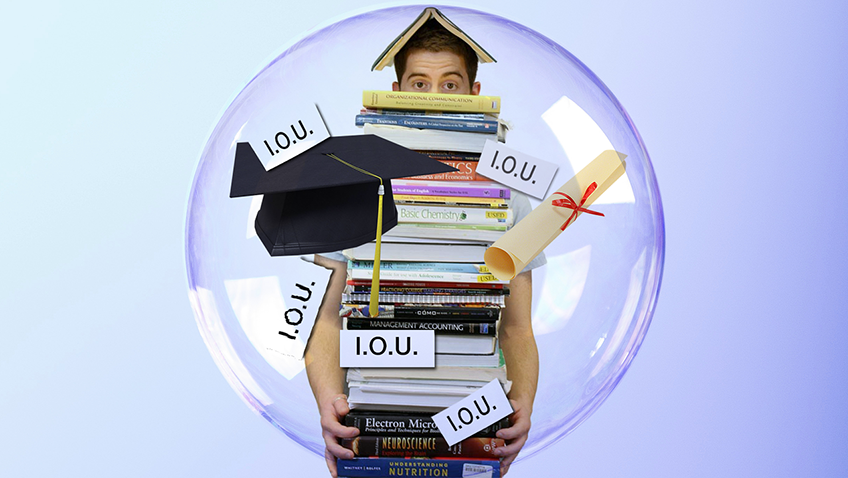

Credit cards and loans are excellent solutions to help us buy the things we want right now and cover the costs in our own time. We’d probably never own a house, a nice car, that holiday of a lifetime or afford the big splurge at Christmas if we didn’t utilise some form or credit at least a few times in our lifetime.

But what happens when we borrow too much? It’s easy to spread our spending over a variety of options and when it becomes a problem instead of a comfortable way of covering additional costs then things have gone too far.

Debt can easily become unmanageable and there are a variety of debt management solutions available. There are specialists who can help get your finances back in order but it is always preferable to keep yourself from getting in such a mess in the first place.

So how can we spot that we’re heading into trouble and prevent it before it goes too far?

Your debt is growing month-to-month

If your debt is increasing each month, whether from failing to make repayments on credit cards, the interest mounting on each statement, or by taking out additional forms of credit to cope with the financial problems you’re already struggling with, then it’s a sure sign you’re heading for trouble.

There are many of us with poor spending habits who simply fail to notice how much is going onto a credit card a catalogue scheme. Spending more than you earn is bad financial practice and needs getting in check right away.

You struggle to make minimum repayments

If you can’t meet the minimum repayments of your credit cards then you’ve bitten off more than you can chew, it’s as simple as that.

Apart from the fines and fees that come with missed repayments a big problem here is that you’re probably not even covering the interest charges let alone the original debt. You’ll be paying into this way longer than you ever should be and could end up paying double the original cost of the item.

Missed payments will damage your credit score so when you want to apply for credit in future you could be doing yourself even more damage in the process.

Your credit score is falling

As previously mentioned, bad debt management will show up on your credit report. This will not only draw your attention to problem areas but also to future lenders. When you start applying for mortgages, business or vehicle loans, it’s devastating having an application denied because of previous poor spending habits.

Controlling your spending and looking after your credit score go hand in hand. If you see your score falling then it’s time to get things back on track.

Saving money seems impossible

If you’re living payday to payday with nothing to show then it’s time to address the problem. If you’re recovering from a financial emergency then you should already have a plan to redress the balance but if it’s simply from living beyond your means not being able to save even the smallest of amounts is telling you that your financial behaviour needs pulling into line.

Find out where your money is going and work on reducing unnecessary spending. How would you live if you lost your job, if your car needed replacing or your roof collapsed? You should consider saving a set amount each month for emergencies and if you can’t? You’re heading for trouble.

You’re borrowing just to pay the bills

Your monthly income should be enough to cover your every day living costs. If you have to borrow just to pay the bills then you’re either not getting paid enough or you’re spending too much.

If you’ve borrowed money from friends and family, a credit agency or moneylender, then you’re not managing your finances properly. If you haven’t organised a comfortable way to pay them back in full then you’re in trouble.

Debt collectors have started calling

If a debt collector has called then you already know that you’re in real trouble. You’ve failed to make payments and your creditors have started to chase you with everything they’ve got. Court action will show on your credit report and judgements will be active for a total of six years.

Credit applications are constantly denied

If you’re making regular applications for new forms of credit you should already be asking yourself why. If you’re being denied those applications it will be due to a poor credit score — and we’ve already discussed what a key indication that is regarding debt problems.

It’s a snowball situation too; the more applications you’re denied the more impact it has on your credit score. Do you really want your current spending behaviour to impact what might be critically important financial situations in the future? Avoid applying for further credit. Find out where your budget is failing and rectify it as soon as possible.

You have to choose between repayments and utilities

Your debt should never impact on your daily living. If handled correctly all credit should be within your means. If you’re in a position where paying for groceries, heating, rent and clothing is in conflict with making your debt repayments then things have gone too far and your debt is out of control.

Occasional financial problems will happen to us all from time to time, so skipping on luxuries or having to make a few regular cutbacks are acceptable money management options but you should never have to skip meals or fail to pay bills.

You’re moving debt from card to card

Moving debt around isn’t a solution. It’s papering over cracks. If you continually move your debt from one option to another this shows that you’re not dealing with the debt, only putting off the problem in the interim. This isn’t healthy financial management and you’re heading for trouble. It would only take a small emergency to tip you over your limit, and without proper resolution that could be just around the corner.

Your financial worries are making you ill

If you’re worrying about money and it’s affecting your physical or mental health then things have gone way too far. You need to address matters straight away as your health is of prime importance. If you become too ill to go to work what kind of problem will your finances be in then?

Anxiety, stress and depression are huge factors when it comes to employment sick leave. Financial problems and mental health issues are closely linked so even when the smallest of worries start to kick in; sleepless nights and stress related stomach upsets, then don’t just visit your doctor to discuss your physical health symptoms, talk to a debt specialist about your financial health symptoms too. Click this for more info