For many pensioners entering their retirement years, their biggest concerns are often financially related. Dropping down from a steady wage to a pension plan can often result in a reduction of money coming into the household.

At this important stage of life, learning to be extra cautious with your pennies can go a long way to ensuring your financial comfort continues. Our friends over at accounting firm Alexander have kindly gathered some beginner’s tips to all pensioners looking for ways to save the cash.

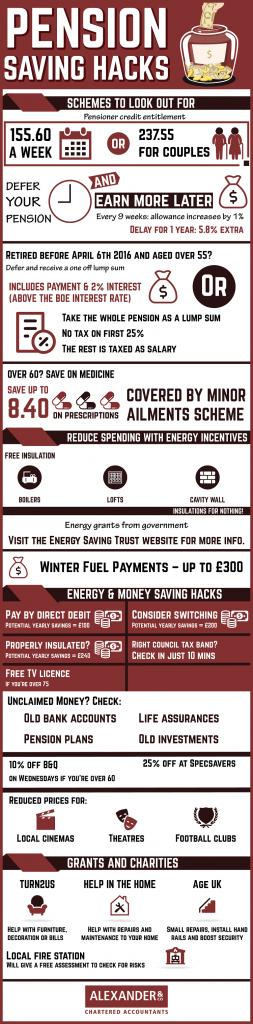

Government schemes and general pension advice

The government’s pension scheme is actually more flexible than many believe. Pensioner credit entitlement is dependent on you cohabiting situation. Many people aren’t aware that by deferring your pension end date you can improve the amount of money your pension produces.

How and when you decide to take your pension will affect just how much money you receive at the end. More information we recommend giving the pensions advisory service a call on 0300 123 1047.

In the later years of our life, it is inevitable that we will become more reliant upon medicines to keep us healthy. It is, therefore, worthwhile knowing and understanding just how much money we can save through the minor ailments scheme.

The minor ailments scheme allows your local pharmacist to diagnose and treat minor ailments for free for those ages 60 or over. This is to help speed up the process and free up the time of GPs. Pharmacies are also open longer hours than the doctors and can, therefore, be accessed quicker in times of need.

For a quick win, take a look at your energy bills and compare with other suppliers. There are schemes and charities which will help you with the installation of new boilers, cavity walls and insulations which will help you to save energy prices in the long run.

Energy saving and other discounts

Government incentives such as winter fuel payments and other energy schemes can help reduce the monthly spend on energy bills. Rising energy prices are forcing pensioners to delay turning on the heating. This should not be the case; we recommend contacting the energy helpline (an accredited customer focus watchdog) who can help to compare your energy prices to find you the best deal possible.

They will also be able to offer you personalised individual advice. You can contact Energy Helpline on 0800 074 0745.

It’s worth understanding that two or less residents in a home will save money switching to a water metre rather than a flat rate. There is no charge to switch suppliers and you can switch back at any time If you are considering switching, this easy to use water meter calculator will help you to see just how much you can save.

Remember to double check all tax codes and council tax payments as in previous years the tax offices have been proven to make mistakes. The bureaucracy of government offices means that any changes or reductions in prices would most likely be missed. You could be spending a lot more than you need too.

Other tips Alexander have providing include featuring some basic discounts at local shops and places of entertainment such as discounted cinema tickets and museum concessions.

Charities and grants

Finally, Alexander takes a closer look at the charities and grants that are available to certain pensioners on a low income. Charities can help assist through sourcing furniture, repairs, security or mobility. All of these grants and charities can help pensioners enjoy their retirement without the worry of overhanging debts.

Turn2Us can help with decorations or bills if there is any issue. Age UK are also a charity which can help with small repairs and help around the home, so don’t hesitate to contact them for any issues you are having.